iInvestFund: Track Investment in Mutual Funds

- Rick

- Apr 12, 2017

- 5 min read

Updated: Jan 9, 2021

There are many investment vehicles in the market, like stocks, Forex, mutual funds, etc. And also alternative investment vehicles for higher-risk investors too. Mutual fund is a portfolio of different stocks in a specific region or from a specific industry or sector. Most insurance-linked investments are mutual fund investments.

Unlike investment in stocks, where investors have to do their own due diligence on which stocks to invest in, mutual funds (or unit trusts) are managed investments. They are managed by fund managers who have more insights into specific regions, industries, company stocks and economics. Investors will decide which funds to invest their money and respective fund managers will decide where to put the pool of investment money according to fund objectives.

Unless an investor choose to invest with only one fund manager and in mutual funds under that very manager, investment in mutual funds usually involve multiple fund managers, different funds of varying objectives and also trading on different platforms. The latter is where the inconvenience arises. When investors want to check the performance of their investments, they often have to log onto several trading platforms to check the fund prices and respective current values of their investments.

iInvestFund is designed for investors and users to monitor all investment in mutual funds and compute gross returns in one app without having to log on to multiple trading platforms. Use the trading platforms only for carrying out actual trades. Track performance with iInvestFund.

Monitoring Fund Performances

It is necessary to monitor mutual fund investments as fund prices can go up and down over the years. Many people believe that long-term investments often reap profits. That is not really true and largely dependent on the businesses, industries or regions where the money is being invested. There are funds that have negative performances after 15 years. When desired profit levels are achieved or when funds are not performing after long periods due to long-term issues, it is often time to sell or re-invest in funds that have growth prospects.

iInvestFund uses "Portfolio" as the grouping container to hold multiple fund investments. It can be setup based on common source of investment money, common objectives or according to different fund managers or trading platforms.

After setting up one or more portfolios of invested funds, iInvestFund will show the performance of every portfolio with respect to their initial investment cost. Performance of individual fund investment can also be viewed after tapping into the respective portfolio.

Update Fund Prices

iInvestFund allows fund prices to be updated in the app. Once the prices changed, all portfolios will be updated with new current values.

Unlike stocks where stock prices can usually be obtained from a single provider, fund prices are usually obtained from respective fund manager's websites or from trading platforms. This makes auto-updating of fund prices impossible.

To make it easier to update prices, iInvestFund incorporated a feature for fund price websites to be shown in the app by saving their URLs. The websites can then be launched automatically and shown in the same view for fund price updating. Users do not have to launch web browsers to find the prices and then copy them into the app.

Track Returns of Investments

The main objective of iInvestFund is to compute returns of all mutual fund investments, giving an overall view on investment performances on different platforms. iInvestFund provides a facility to set a desired target price for each invested fund. When a fund price hit or exceeded the set target price, an alert will be shown to highlight the target-achieved fund to the user.

A Summary of Returns module is also provided to give a quick overview of past and current returns. iInvestFund keeps tabs on both realised and unrealised returns to provide a gross total for all investments.

Account for Fees

There are several types of fees for mutual fund investments. Not all fees are applicable, so do understand what they are before investing.

Purchase or Sales Fee (one-time)

Account or Platform Fee (regular)

Management Fee (regular)

Exchange or Switch Fee (as and when it takes place)

Redemption Fee (one-time)

Others (refer to Wikipedia for more)

When computing returns of investments, most fund managers and trading platforms will not take fees into consideration when showing the returns, probably due to their complexities. As a result, returns figures shown will always be higher than actual amounts profited. Or in cases where there are losses, the figures shown will be lesser than actual amounts lost.

iInvestFund takes into considerations all fees to compute actual returns. Front-end and back-end fee structures can be defined and optionally be auto-applied for all buy and sell transactions in the app. In this way, iInvestFund can compute current returns after taking into account front-end fees and any adhoc fees. It can also forecast actual returns before selling by calculating back-end fees (if any) and minus it from expected returns.

As fee structures can only be defined by users based on the charging system of the trading platforms used, there is no way iInvestFund can know if the structures are defined correctly. So, iInvestFund provides a "fee calculator" for checking each fee structure (see diagram above). Simply simulate a trade value and the calculator will use the defined structure to work out the fee. If the fee is correct, the fee structure is defined correctly.

Dividend & Reinvestment

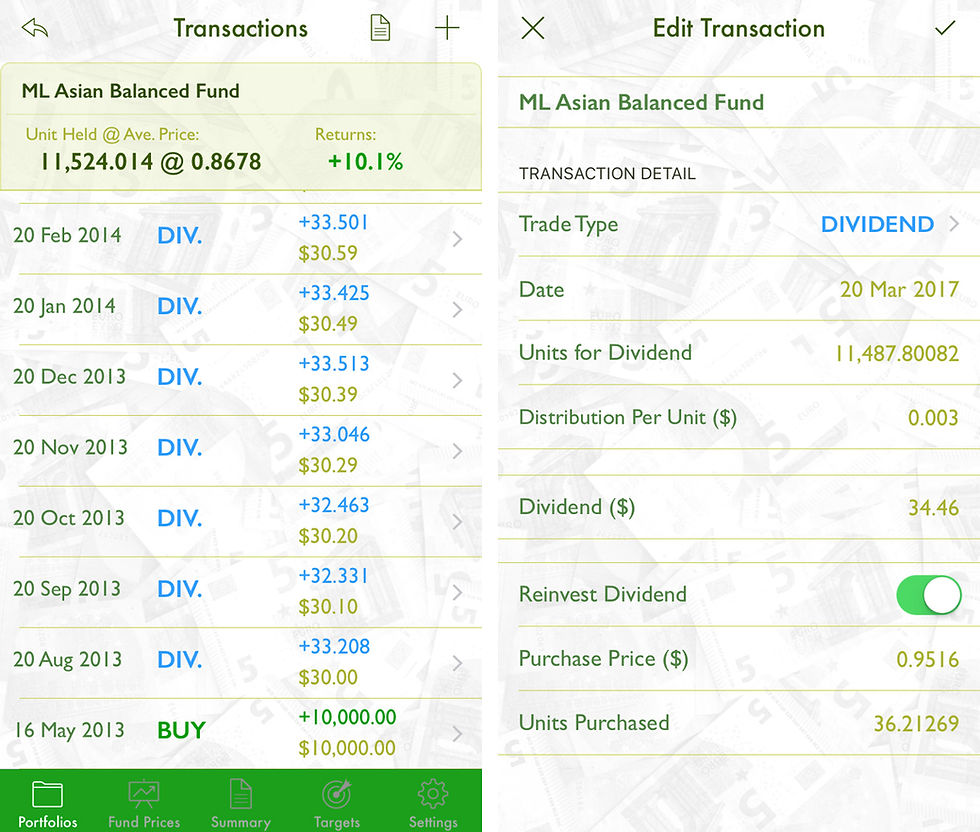

Apart from normal buy and sell transactions, iInvestFund also tracks dividend payouts, which are part of realised returns too.

iInvestFund has the capability to handle re-investment of dividends back into funds. In such cases, reinvested dividends are not considered as realised returns but added back to the respective fund as additional units. The cost basis of the investment will also be computed by averaging the initial cost and cost of reinvestment of all dividends.

Fund Switch

A fund switch, or fund exchange, is selling of an invested fund and buying of another fund without taking out any money. This is normally done within the same fund manager. An exchange fee may be applicable and is usually cheaper than a redemption fee and/or purchase fee. Some insurance-linked investments may provide limited fund switching for free.

iInvestFund provides fund switch function to assist in the process of creating switch-sell and switch-buy transactions. This allows iInvestFund to track investment returns accurately without mistaking fund switches as the usual sell and buy transactions.

Data Privacy & Security

iInvestFund do not link to any financial institutions to perform actual trades. All data entered into iInvestFund is stored on your device only and is accessible only by you.

iInvestFund also provides option to enable password protection as well as biometric authentication on iOS devices.

One More Thing iInvestFund is also part of a bundle of personal finance applications, called Wealth Suite Bundle, and MyWealth App. MyWealth is a free application to compute your current total wealth and for monitoring financial health. It can sync data automatically with all apps in the Wealth Suite Bundle.

iInvestFund will sync the total current value of all mutual fund investments with MyWealth.

The Wealth Suite bundle consists of another 3 finance apps, namely iInvestStock, iTreasurer and iInsured. Download both the Wealth Suite Bundle and MyWealth today.

Comments